Debt is a four letter word that you can live with out. It causes money stress and doesn’t let you enjoy life if all you are worrying about is how to make ends meet. But is all debt bad? When you’ve been in debt like I have, you don’t see any good aspects to it because you can’t get ahead if all your money is going towards paying debt.

Definitely the worst debt to have is unsecured debt. This is debt such as credit cards. Unsecured debt means there is no security against this debt that can cover it should you default. Whereas secured debt, such as a mortgage, is covered by your home.

Definitely the worst debt to have is unsecured debt. This is debt such as credit cards. Unsecured debt means there is no security against this debt that can cover it should you default. Whereas secured debt, such as a mortgage, is covered by your home.

A secured debt is easier to get rid of because you essentially could sell your home if hard times come up. Whereas unsecured debt is something you would be paying long-term if you don’t have enough money to cover it and with the added interest charges, which usually are high on credit cards, is an endless battle to get rid of it.

I personally don’t believe in having unsecured debt if you want financial freedom because it will drain you and there is no enjoyment in having extravagant things if all it does is cause financial hardship. But that doesn’t mean go buy yourself an expensive home just because it’s secured. Can you afford the mortgage payments and do you have enough of an emergency fund say if you lost your job? Secured debt still has to be affordable to make the monthly payments.

When managing finances, I would stay away from unsecured debt because racking up credit card debt is living beyond your means and a surefire way to the poorhouse. To effectively handle unsecured debt means you have to pay it off at the end of each month and even with all good intentions it can easily unravel if you get carried away. Buy now and pay later will never leave you any money for anything else and more than likely it will tempt you to buy things you normally couldn’t afford. On top of it there are interest charges to pay, which means you are making someone else rich rather than yourself.

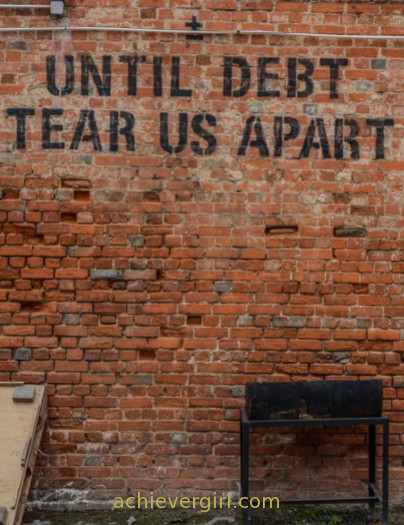

It’s true debt can tear apart relationships as disagreement about finances is many times the issue behind divorces. Money stress can weigh heavy on a relationship and can be avoided by living within your means to stay out of debt.

Some years back, I was in debt over my head and had no choice but to sell my home to get out of it. I regret that I had to give up my home, as was my sanctuary, but don’t regret getting out of debt. I now would only have secured debt, specifically a mortgage for a house, because real estate I consider is an investment which can be sold to cover the mortgage debt and also to gain a profit when the house values increase.

I cannot emphasize more that unsecured debt is the worst debt to have but all debt can be bad, whether unsecured or secured, if you don’t have the means to pay it.

Would you like to get out of debt? Why not consider a blog to earn extra money to pay off your debt? Blogging is what I’m doing to reach my financial freedom goal. CLICK HERE for my easy tutorial on how to get your blog started and live within minutes!

92/365